New

Dec 4, 2019 9:41 PM

#1

>US corporate debt has swelled to nearly $10 trillion, according to data recently cited by The Washington Post. >That comes out to roughly 47% of the overall economy, which is a record, The Post found. >Experts from the International Monetary Fund to the trillion-dollar asset manager BlackRock have warned of the risk posed by ballooning investment-grade debt. >Since the 2008 financial crisis, companies have issued record levels of bonds to investors amid historically low interest rates. US corporations are sitting on nearly $10 trillion in debt. That's equivalent to roughly 47% of the overall economy, a record, according to data cited by The Washington Post. Since the financial crisis in 2008, corporations have splurged on debt amid historically cheap borrowing costs. In recent months, experts have warned that ballooning corporate debt could worsen a future economic downturn. Here's what experts from the International Monetary Fund to the trillion-dollar asset manager BlackRock have said about rising corporate debt. International Monetary Fund As central banks around the world have loosened monetary policy over the past decade, corporations have felt encouraged to pursue "financial risk-taking," according to a report from the IMF published in October. That dynamic has made some systemically important economies more vulnerable to an economic slowdown, the report found. "Corporate leverage can also amplify shocks, as corporate deleveraging could lead to depressed investment and higher unemployment, and corporate defaults could trigger losses and curb lending by banks," the IMF wrote. In a recession half as severe as the 2008 financial crisis, corporate debt-at-risk - which is owned by firms that can't cover interest expenses with their profits - could increase to $19 trillion, or almost 40% of total corporate debt in major economies, the IMF said. BlackRock The trillion-dollar asset manager said in an October report that BBB-rated bonds, the lowest bracket of the investment-grade debt, accounted for more than 50% of the market, compared with 17% in 2001. As demand for investment-grade debt has grown, the creditworthiness of issuers has fallen. According to BlackRock, leverage levels are creeping toward the highest readings since 1992. The firm measured leverage using a ratio of debt minus cash and cash equivalents to 12-month EBITDA. "We believe the sharp increase in the proportion of BBB-rated constituents has made the investment-grade bond sector riskier than in recent years," BlackRock wrote. "BBB-rated bonds are typically the most vulnerable of all investment-grade debt in a recession." If BBB-rated bonds were downgraded, they would then be considered high-yield debt, or "fallen angels," which could cause their value to fall, the firm added. The Federal Reserve The central bank warned in its November "Financial Stability Report" that the riskiest companies accounted for the bulk of rising debt in recent years. The Fed also expressed concern about outstanding BBB-rated debt approaching an all-time high. "In an economic downturn, widespread downgrades of bonds to speculative-grade ratings could lead investors to sell the downgraded bonds rapidly, increasing market illiquidity and downward price pressures in a segment of the corporate bond market known already to exhibit relatively low liquidity," the central bank wrote. The ratio of debt to assets for all publicly traded nonfinancial companies has hit its highest level in two decades, and the leverage ratio among debt-heavy firms is near a historical high, the Fed added. https://markets.businessinsider.com/news/stocks/us-corporate-debt-10-trillion-record-percentage-economy-expert-warnings-2019-12-1028731031#international-monetary-fund1 All this points to potential trouble down the road whenever the next recession hits. It's a problem if corporations are focusing their resources on paying back their debts and an even bigger one if they start defaulting en masse, resulting in banks tightening their loaning practices. The article cites loose monetary policy by the Fed as encouraging this, which is a policy Trump has been pressuring the Fed to undertake, up to demanding negative interest rates, as I pointed out in a previous thread. If banks tighten their loaning practices, we won't have much room to encourage them to loosen them again with interest rates being so historically low. |

FreshellDec 4, 2019 9:45 PM

Dec 4, 2019 9:44 PM

#2

| Fed's Powell: Debt is growing fast than economy, and that's not sustainable good luck world economy seeing that the world currency is still the USA dollars so its bound to domino effect around the world too |

Dec 5, 2019 1:05 AM

#3

| Didn't Trump say the economy is how his presidency should be judged? Artificially inflating it is now coming back to haunt him. |

|

Dec 5, 2019 12:07 PM

#4

deg said: Fed's Powell: Debt is growing fast than economy, and that's not sustainable good luck world economy seeing that the world currency is still the USA dollars so its bound to domino effect around the world too Not really related since this is about corporate debt and he's speaking about national debt. But yes, the national debt Trump caused by doing tax cuts for the wealthy during a period of economic expansion isn't very good. I believe corporate debt is a more immediate problem though. Especially during a downturn. But on that. I'm glad the Fed chair laid out that the problem isn't having a national debt in itself, but not having the gdp growth that outweighs any growths in debt. Right wingers usually fear monger that we need to wipe our debt completely clean. That said, this is a problem caused by the right cutting taxes, and it's a problem that should be handled by reversing them. Cut military spending if you want to do a cut. But they'll use this as a political tool and cry that we need to cut government pensions and medical care for the elderly if a Democrat gets in office. I'm sure Biden would comply with that. |

Dec 5, 2019 1:39 PM

#5

| @Freshell i did not know that corporate debt cannot be tied with the national debt like in my mind they are related in a way that they are simply debt by the country, i mean didnt the 2008 recession started by corporate debt from Wall Street and they are bailed out by the tax payers and borrowing from other countries like China that further increase the national debt? so they are link |

Dec 5, 2019 1:39 PM

#6

| Not much to add since it was hard enough understanding it (Thank Investopedia for that). Isn't Toranpu-sama easing monetary policy a good idea? I'm stupid so I don't know but it looks good at face value as with the risk of investment-grade bonds downgrading businesses'll need interest rate lowered for available credits and maintain creditworthiness. I feel like the stonks meme right now pls no bully. |

|

Dec 5, 2019 2:53 PM

#7

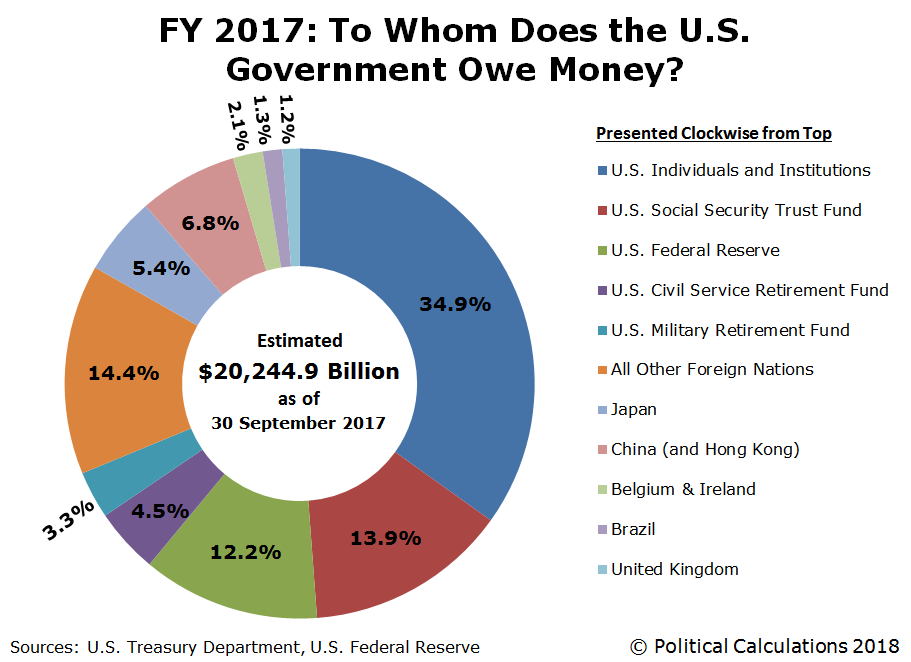

deg said: @Freshell i did not know that corporate debt cannot be tied with the national debt like in my mind they are related in a way that they are simply debt by the country, i mean didnt the 2008 recession started by corporate debt from Wall Street and they are bailed out by the tax payers and borrowing from other countries like China that further increase the national debt? so they are link I mean, yeah, if we did another bailout, there'd be a link in that sense. Not the same thing though. Despite the "the U.S. is reliant on China for taking debt" meme, the government owes a lot more money to individuals and corporations.  In other words, some of our national debt is actually an asset to corporations. Actually counts against their debts. That's another relationship of course, but it shows how they're not the same thing. @Orhunaa Consider what happens when the next recession happens and corporations are unable to pay off their record levels of debt. Who will want to invest? Investors will sell off their assets and run for the hills. Banks will tighten their lending practices. Perhaps we could give banks access to low interest loans to prompt them to loosen their standar- oh, we already massively cut interest rates before the recession. Common wisdom is that you cut rates during a recession and you raise them during an expansion. |

FreshellDec 5, 2019 2:57 PM

Dec 5, 2019 3:07 PM

#8

Freshell said: @Orhunaa Consider what happens when the next recession happens and corporations are unable to pay off their record levels of debt. Who will want to invest? Investors will sell off their assets and run for the hills. Banks will tighten their lending practices. Perhaps we could give banks access to low interest loans to prompt them to loosen their standar- oh, we already massively cut interest rates before the recession. Common wisdom is that you cut rates during a recession and you raise them during an expansion. Oh I see so it should be reserved for dire times, thank you very cool! Wait, does that mean recession is pretty much inevitable? |

|

Dec 5, 2019 3:23 PM

#9

Orhunaa said: Freshell said: @Orhunaa Consider what happens when the next recession happens and corporations are unable to pay off their record levels of debt. Who will want to invest? Investors will sell off their assets and run for the hills. Banks will tighten their lending practices. Perhaps we could give banks access to low interest loans to prompt them to loosen their standar- oh, we already massively cut interest rates before the recession. Common wisdom is that you cut rates during a recession and you raise them during an expansion. Oh I see so it should be reserved for dire times, thank you very cool! Wait, does that mean recession is pretty much inevitable? It's generally modeled as something that happens due to external shocks. I'll be a simple man in my doubt with regards to that. Find me a time where we solved the problem of economic boom and bust and I'll perhaps believe that recessions aren't inevitable. Politicians always promise they'll be the ones to solve that problem. Then another one happens. We haven't had a recession in 11 years. That's the longest expansion in our history. I think if we don't consider the moment in history we're living to be special, the rational conclusion is we're going to have another one some time not too long. You'll notice I never blame Trump for a potential upcoming recession. I'll just blame him for making it worse than it potentially needed to be. Though he may be accelerating a downturn with his sporadic tariff wars and what not. I'll admit that. |

Dec 5, 2019 6:30 PM

#10

Yudina said: Private/individual debt has pretty bad consequences for individuals but up to this point I don't think anyone's been able to properly explain to me why debt is bad for governments and corporations. I haven't gone through academic papers in a long time, but based on academic/work experience the answer is it's not nearly as big of a deal. For the record, it's seen as bad for a company to have no debt, but obviously we're talking here about "historic" levels of debt. Regardless, we as individuals naturally have an inclination to be fearful of debt because to us it means foreclosure, bankruptcy, and so forth, but debt is just another instrument in the financial arsenal. There was some study by a Harvard professor a while ago by the name of Ken Rogoff and he was probably one of the last big pushes to definitively prove that high levels of debt led to austerity, but the guy's conclusions were based off the back of extremely poorly built Excel spreadsheets so it's hard to trust anything he had to say. (Lol, I was outside and accidentally posted an incomplete thought) Debt is at its worst when there's a speculative bubble with loose lending standards culminating in a Minsky moment. Not guaranteed that a bubble will burst, but I just wanted to bring up that businesses are taking on higher debts than ever to show that a similar crash as '08 shouldn't be out of question. At the very least, this will be problematic if a recession hits while they're handling these record level debt-to-GDP ratios, since commerce will go down. Just something else to add to the vicious circle of unemployment that happens during a recession. Oh and I don't think debt is intrinsically bad. No. This is a very neoliberal take on economics and one that's very ahistorical. Recessions in 18th and 19th century America could stretch between thirty to almost a hundred years and trends like that were similar elsewhere on the globe. Economies didn't boom or bust in the same way they did before the industrial revolution, just another sign that our modern cyclical nature of economics is not one that's bred from human civilization but the specific form of industrial/private enterprise that we have, for whatever reason, decided best fits our interests. I just wanted to post the orthodox view before proceeding to say that I doubted it. I'm aware that it's a post industrial revolution phenomenon. I believe it's intrinsic to our current mode of production and see no reason why electing a Hilary Clinton would prevent an upcoming recession anymore than a Donald Trump, even if he may accelerate things. |

Dec 5, 2019 8:26 PM

#11

Yudina said: Okay, but the financial crisis in '08 didn't really happen because there was too much debt. Debt is merely a symptom rather than a cause, really. '08 coincided with an extremely rapid accumulation of debt over a short period of time followed by mass defaulting on loans. That worsens the situation. Of course, no one is predicting that this will happen again. If it did I'm sure most experts would only figure out which sector would crash in hindsight, as with last time. I didn't post this as a doom and gloom "the next recession will definitely be as bad as the last one or worse" but as a "here's a risk factor to consider" type thing. I mean American presidents have little to no impact on the economy so, yes, I don't see much consequential difference between any political party because the economy sits above the political level in terms of what America can reasonably control. Regardless of which party held control of the legislature too, as I see it. I'm not for radically upheaving the economy, but we can do things around the edges that helps mitigate how bad a recession is whenever it hits. That's more or less where I am on things, and I see Trump as a force doing the opposite of mitigation. |

Dec 6, 2019 6:00 PM

#12

| American Presidents have little to no impact on the economy? Surely that is a mistype Not surprising results seeing how interest rates are low, but risky none the less. |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 6, 2019 6:39 PM

#13

| Job reports indicate the USA has the best numbers in decades now. But keep reaching. They're winning the trade war. |

Dec 6, 2019 7:28 PM

#14

| Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. |

|

Dec 6, 2019 9:31 PM

#15

SpamuraiSensei said: Never heard numbers aren't quality? Almost 50% of those working in the US are at low-wage jobs: offer no benefits for health insurance, development nor opportunities to advance. This means there are Fewer new jobs which are actually "good" jobsJob reports indicate the USA has the best numbers in decades now. But keep reaching. They're winning the trade war. Just cause someone gets a shiny handmedown, and polishes it more doesn't mean the item is exactly "better" Soverign said: So you understand the corporations owe some of it to the government and the larger majority to banks, but wondering how it would impact the nation? Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. |

SilverstormDec 6, 2019 9:38 PM

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 6, 2019 9:37 PM

#16

Silverstorm said: SpamuraiSensei said: Never heard numbers aren't quality? Almost 50% of those jobs are low wage and offer no benefits for health insurance, development nor opportunities to advance. Job reports indicate the USA has the best numbers in decades now. But keep reaching. They're winning the trade war. Just cause someone gets a shiny handmedown, and polishes it more doesn't mean the item is exactly "better" Soverign said: So you understand the corporations owe some of it to the government and the larger majority to banks, but wondering how it would impact the nation? Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. You don't know what you are talking about. I can see you aren't well versed in this topic. Please read up. |

Dec 6, 2019 9:38 PM

#17

Silverstorm said: Soverign said: So you understand the corporations owe some of it to the government and the larger majority to banks, but wondering how it would impact the nation? Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. It would seem quite dire indeed if these same corporations wasn't outed ever other year for tax evasion with offshore tax havens. Made all the easier by free trade and globalism. So obviously, the only way to protect the nation is to pass more free trade laws and let the market self regulate. I feel like corporations owing the guberment nearly 50% to be blatant communism. |

|

Dec 6, 2019 9:43 PM

#18

Soverign said: How does free trade and globalism allow corporations to more easily setup offshore accounts? Silverstorm said: Soverign said: Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. It would seem quite dire indeed if these same corporations wasn't outed ever other year for tax evasion with offshore tax havens. Made all the easier by free trade and globalism. So obviously, the only way to protect the nation is to pass more free trade laws and let the market self regulate. I feel like corporations owing the guberment nearly 50% to be blatant communism. And if true how would increasing those mechanisms with less oversight into their practices protect the nation from companies not paying back?--seems that would only increase such tax evasion practices by increasing the things you said make it easier to begin with |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 6, 2019 9:50 PM

#19

Silverstorm said: Soverign said: How does free trade and globalism allow corporations to more easily setup offshore accounts? Silverstorm said: Soverign said: So you understand the corporations owe some of it to the government and the larger majority to banks, but wondering how it would impact the nation? Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. It would seem quite dire indeed if these same corporations wasn't outed ever other year for tax evasion with offshore tax havens. Made all the easier by free trade and globalism. So obviously, the only way to protect the nation is to pass more free trade laws and let the market self regulate. I feel like corporations owing the guberment nearly 50% to be blatant communism. And if true how would increasing those mechanisms with less oversight into their practices protect the nation from companies not paying back?--seems that would only increase such tax evasion practices by increasing the things you said make it easier to begin with You gotta be kidding me. Edward Kleinbard, a former corporate lawyer who is a professor of tax law at the University of Southern California, told the International Consortium of Investigative Journalists: “US multinational firms are the global grandmasters of tax avoidance schemes that deplete not just US tax collection, but the tax collection of almost every large economy in the world.” https://www.theguardian.com/news/2017/nov/06/apple-secretly-moved-jersey-ireland-tax-row-paradise-papers That doesn't even take into account the loss of jobs from offshore outsourcing, Because it is cheaper to pay someone pennies on the dollar in a lesser developed country. Then turn around and sell the finished products for a premium in a first world country. If that isn't putright feasible they will make all of the components outside the country then assemble them in one central location then put made in Murica on it. The Fed isn't controlled by the elected government you know. |

|

Dec 6, 2019 9:54 PM

#20

Silverstorm said: American Presidents have little to no impact on the economy? Surely that is a mistype Not surprising results seeing how interest rates are low, but risky none the less. Yeah. I didn't want to get into the mud with that since "little to no effect" is subjective depending on what you think "little" means. Wanted to stick to the point that recessions are pretty inevitable and having the fed cut interest rates prematurely so much ain't smart. |

Dec 6, 2019 10:05 PM

#21

Soverign said: It is good to know all that but it didn't answer my questions to what you raised. You moved the goalpost. So some companies decide to conduct business in a country with less regulatory laws (harming the workers in most cases), and sell said product at higher prices (unfair to consumers). Meanwhile they go to lower rated tax spots to keep taxes on their profits--wheres the offshore accounts part? This was offshore factories and legal tax-rate skipping. In the context of offshore accounts, there are only a few countries with legislation that allows their banks to conduct business in such a way and those aren't the ones the companies produce in. This is legal evasion by picking the places that would tax the least; still evasion but not the same as hiding profits entirely. Silverstorm said: Soverign said: Silverstorm said: Soverign said: So you understand the corporations owe some of it to the government and the larger majority to banks, but wondering how it would impact the nation? Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. It would seem quite dire indeed if these same corporations wasn't outed ever other year for tax evasion with offshore tax havens. Made all the easier by free trade and globalism. So obviously, the only way to protect the nation is to pass more free trade laws and let the market self regulate. I feel like corporations owing the guberment nearly 50% to be blatant communism. And if true how would increasing those mechanisms with less oversight into their practices protect the nation from companies not paying back?--seems that would only increase such tax evasion practices by increasing the things you said make it easier to begin with You gotta be kidding me. Edward Kleinbard, a former corporate lawyer who is a professor of tax law at the University of Southern California, told the International Consortium of Investigative Journalists: “US multinational firms are the global grandmasters of tax avoidance schemes that deplete not just US tax collection, but the tax collection of almost every large economy in the world.” https://www.theguardian.com/news/2017/nov/06/apple-secretly-moved-jersey-ireland-tax-row-paradise-papers That doesn't even take into account the loss of jobs from offshore outsourcing, Because it is cheaper to pay someone pennies on the dollar in a lesser developed country. Then turn around and sell the finished products for a premium in a first world country. If that isn't putright feasible they will make all of the components outside the country then assemble them in one central location then put made in Murica on it. The Fed isn't controlled by the elected government you know. @Freshell Ok, understood. I think this thread needs a vidoe on the topic just so users have a basic foundation on the relationship between the Fed, interest rates, banks and the government. Ted makes a good video for this, though its simplified, gets the job done |

SilverstormDec 6, 2019 10:11 PM

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 6, 2019 10:14 PM

#22

Silverstorm said: Soverign said: It is good to know all that but it didn't answer my questions to what you raised. You moved the goalpost. So some companies decide to conduct business in a country with less regulatory laws (harming the workers in most cases), and sell said product at higher prices (unfair to consumers). Meanwhile they go to lower rated tax spots to keep taxes on their profits--wheres the offshore accounts part? This was offshore factories and legal tax-rate skipping. In the context of offshore accounts, there are only a few countries with legislation that allows their banks to conduct business in such a way and those aren't the ones the companies produce in. This is legal evasion by picking the places that would tax the least; still evasion but not the same as hiding profits entirely. Silverstorm said: Soverign said: How does free trade and globalism allow corporations to more easily setup offshore accounts? Silverstorm said: Soverign said: So you understand the corporations owe some of it to the government and the larger majority to banks, but wondering how it would impact the nation? Whom are these risky corporations in debt to though? Basically, Trump cut taxes so that they would borrow huge sums of money from the guberment. Or more precisely if you follow the stream all the way back to its source, The Federal Reserve? Besides, you can never trust these fucks. Hurr hurr we have been losing money since the sixties that is why your wages have have remained stagnant you blue collar wagecuck, We only raise minimum wage because of inflation or you would be working to starve to death hurr hurr. Then you might wise up and opt out. Like, private companies was underestimating their own oil field reserves by such a degree in the seventies that scientists thought the world would be depleted of crude oil by the nineties. It would seem quite dire indeed if these same corporations wasn't outed ever other year for tax evasion with offshore tax havens. Made all the easier by free trade and globalism. So obviously, the only way to protect the nation is to pass more free trade laws and let the market self regulate. I feel like corporations owing the guberment nearly 50% to be blatant communism. And if true how would increasing those mechanisms with less oversight into their practices protect the nation from companies not paying back?--seems that would only increase such tax evasion practices by increasing the things you said make it easier to begin with You gotta be kidding me. Edward Kleinbard, a former corporate lawyer who is a professor of tax law at the University of Southern California, told the International Consortium of Investigative Journalists: “US multinational firms are the global grandmasters of tax avoidance schemes that deplete not just US tax collection, but the tax collection of almost every large economy in the world.” https://www.theguardian.com/news/2017/nov/06/apple-secretly-moved-jersey-ireland-tax-row-paradise-papers That doesn't even take into account the loss of jobs from offshore outsourcing, Because it is cheaper to pay someone pennies on the dollar in a lesser developed country. Then turn around and sell the finished products for a premium in a first world country. If that isn't putright feasible they will make all of the components outside the country then assemble them in one central location then put made in Murica on it. The Fed isn't controlled by the elected government you know. You already answered your own question. These corporations owe the banks and through them, the Federal Reserve the bulk of these outstanding debts. Nothing will be accomplished until the government has the balls to reign them in. Which hasn't happened since Jackson was president. What I mean specifically is, nothing you, the president, or I do, will make any difference (barring the use of fascist imperial military force. which I am all for knocking on the Feds door with some Abrams tanks) <3) . "Permit me to issue and control the money of a nation, and I care not who makes its laws!" — Mayer Amschel Bauer Rothschild https://www.investopedia.com/articles/investing/081415/understanding-how-federal-reserve-creates-money.asp Simplistically speaking, even the US Government buys it's money from the Fed. To then tax and pay back the Fed. I can only pray God Emperor Trump makes me the commander of such a glorious expedition so that I may shout from my M1 Abrams tank. "FEDERAL RESERVE!!! LET MY PEOPLE GO!!!". As I part their reinforced vault doors with a depleted uranium sabot round.  |

SoverignDec 6, 2019 11:23 PM

|

Dec 7, 2019 12:56 AM

#23

Soverign said: I can only pray God Emperor Trump makes me the commander of such a glorious expedition so that I may shout from my M1 Abrams tank. "FEDERAL RESERVE!!! LET MY PEOPLE GO!!!". As I part their reinforced vault doors with a depleted uranium sabot round. Sadly, God Emperor Trump doesn't want to stop at the Fed handing out low interest loans but wants them to give no interest loans plus when they're paid off, hand out some free money. Unless him saying he wants to fire Powell over not lowering interests more is some sort of 5D chess I'm not seeing. dun dun dun |

Dec 7, 2019 1:48 AM

#24

Freshell said: Soverign said: I can only pray God Emperor Trump makes me the commander of such a glorious expedition so that I may shout from my M1 Abrams tank. "FEDERAL RESERVE!!! LET MY PEOPLE GO!!!". As I part their reinforced vault doors with a depleted uranium sabot round. Sadly, God Emperor Trump doesn't want to stop at the Fed handing out low interest loans but wants them to give no interest loans plus when they're paid off, hand out some free money. Unless him saying he wants to fire Powell over not lowering interests more is some sort of 5D chess I'm not seeing. dun dun dun Trump is funny. Just a layer of obfuscation. Like, oh noes the government vs the corporations! Which team are you on? While they all pay their taxes interest rates to the Fed. If he really wanted to stop illegal immigration he would use the lever of the US government to curb stomp the corporations that incentivise them. https://slate.com/news-and-politics/2017/02/ices-crackdown-is-beyond-aggressive-its-illegal.html Why bother with the small fish when you can go directly to the biggest fish. Do you know how much paperwork you even have to do to be legally employed these days? Like, double and triple verification all the way up to the Federal level. https://www.uscis.gov/i-9 How does this keep happening? As long as the corpos are paying their Fed bills they wont use the government to crackdown on them. Unless it is like some kind of Denzel Training Day shakedown tax, cuz they fucked up with some Russians or something. Yo be fair, at the highest level I doubt the money even means anything, just a lubricant to keep the system moving. |

|

Dec 7, 2019 2:12 AM

#25

| @Soverign Trump is definitely a showman. It should be apparent to anyone why ice raiding a business, deporting a few illegals, then not even bothering to slap the business on the wrist won't change anything. Like yeah. I'm sure the business is just going to go right along and be a good boy now, lol. Dude himself created fake green cards for his own illegal workers. Man appreciates some good cheap labor. I don't have an analysis on him that tells me he's a puppet though. Like I know politics is corrupt but being behind Trump getting elected? Eh. I just think he saw a recession was coming and decided to pressure the Fed into giving investors a sugar high so it holds up a while longer. Failing that, he'd just blame the Fed for the recession. |

Dec 7, 2019 3:56 PM

#26

| How I would like someone else to do this correcting of logic *sigh*--non dismissive..non dismissive..member the mantra Yudina said: Question then instead of my normal explanations: Silverstorm said: They don't? Not sure what's so controversial here. Presidents rarely make decisions that affect the economy as a whole.American Presidents have little to no impact on the economy? Surely that is a mistype Who nominates the chair of Federal Reserve? Who is that makes treaties? And who is it that enacts Tariffs? When get the answer, tell me how those things don't impact an economy in big ways. @Soverign You didn't answer my question and I only supplied an answer as to how you didn't. I'm not going to play carousel with you on something you brought up as a point without an explanation. Legally evading taxes is not the same as illegally evading them with offshore accounts, as regulation is inherent in one over the other (counter to your notion of let a free market be "free") @Freshell I agree with your thought on him seeing a impending recession so creating a hollow buffer. Same tactics have been used in the past during the 20s and recently in Southern American countries. The deck is stacked against another Administration if things get aren't managed properly. also found a vid of the situation |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 7, 2019 5:42 PM

#27

Yudina said: Great, a rambler--I wasn't pointing to Fed to supply evidence of their economic capability. Each answer to those questions is the President (nice way of being evasive, but try harder). Silverstorm said: This is like trying to answer the question of someone who doesn't look at markets all day long and therefore doesn't know what the economy looks like. You learn about all these institutions and generic principles and then treat them as if they're by default important when they aren't. Pointing to the Fed immediately is like every online keyboard warrior's virtue signalling starter pack and is by far the worst example of trying to say that the president makes an impact.Question then instead of my normal explanations: Who nominates the chair of Federal Reserve? Who is that makes treaties? And who is it that enacts Tariffs? When get the answer, tell me how those things don't impact an economy in big ways. The last time the Federal Reserve made a seemingly important decision was under Alan Greenspan, but that's a choice that was made by Greenspan (and then maintained and defended by other chairs unrelated to the original president who nominated him). You can ostensibly argue that the low federal fund's rate has had a long standing impact, but any central bank has the same power and not all of them are answerable to a higher executive office (neither is the Fed by the way), so to say that this links to the president is pretty daft. Even in the case of the low interest rate environment, that's not something that impacts the ordinary lives of regular people, which is what this eventually all leads back to anyway in terms of general economic discussion. Sure the stock markets are up but the average person does not see the historic gains we've seen since 2011, but that's the immediate and most notable impact of the Fed policy. There's a clear distinction between stock market performance and the general state of the economy. Even to suggest that the choice/appointment of the Fed chairman itself matters is ridiculous, since the pool of candidates have always acted in relative consistency to one another. Bernanke, Yellen, Greenspan, Volcker, they're all cut from the same cloth despite being in completely different political eras, so the idea that the president's choice matters in this regard is pretty pointless and reflects a poor understanding of history. Janet Yellen is especially hilarious considering everyone originally thought she would breath fresh air into the Board but ended up just kowtowing to same kind of Fed mantra that's been passed down from the Greenspan era. As for tariffs and treaties, this is just pretty silly because there's no real contemporary tariff or treaty that has had outstanding effects on the economy. Sure, the markets tanks for a day when the president decides to set a new tariff on scotch or Chinese productions, or European producer, or pork, or whatever, but these have extremely minute effects on the economy as a whole. What was the last economic treaty that really changed anything? The answer is there hasn't been. NAFTA's been around for two decades now and the impact of that on the U.S. economy is extremely muted compared to other things that people talk about. There are tons of buzzwords about NAFTA's opening of the American worker into the global market or the supply chain integration between Canada, Mexico, and the U.S., none of which really means anything unless you can put it on a calculator. If you believe that the president has extraordinary control of the economy, then you must by proxy argue that the crash in 2008 was Bush's fault (it wasn't). That the recovery from 2008 - 2010 was to Obama's credit (it wasn't). That the economic boom of the post-Obama era has been Trump's achievement (it isn't). So on and so forth. There are very few times where economic performance is tied to what the president actually does (Glass-Steagall is a notable example), but this country thinks that is the case because that's what the election seasons trains them to think. The chairman is nominated by the President--who normally tries to find a person that shares in their economic goal for their own administration. Just cause the average person doesn't see how the relationship between stock market success and their lives doesn't mean it has no significant impact on them--whose fiscal policies are pushed by an administration--led by a president as the decider of said policies. The companies (large and small) adjust their own way of business with the consumer market by measuring how their stock performance is going. Yes, look at 2007-2009 if you don't see a connect between industry to stocks and how that effects people as insurance firms, automobile industry, and banking firms fall in the stock market played out in their lives. Sure, Yellen is credited with doing a quasi-reversal of a previous Chairmen (Bush 1st admin nomination), so to suggest she did the same thing is disingenuous to how she "kowtowed" the economy with the Obama administration to increase stock market values by keeping interest rates at particular levels so the economy could rebound from its freefall. And thats a poor answer about tariffs and treaties. Tariffs have harmed an entire industry (Agr) currently in the US, just as treaties have helped/harmed industries in other countries (Mexico, Canada) to the point Congress had to give essentially welfare to the farmer whose products weren't going to get bought. Like Soverign, your just dancing around directly answering by posting some big ass paragraph of personal opinion that doesn't make sense on a basic level. Thank you for wasting the time to supply a shitty answer I guess is all there is to say, cause i'm not going to waste the time supplying the links that plainly show you like digging things out of your ass. But please continue to post..cause i want this forum to see it too Yudina said: Yeah, as a result of the President's actions. An economy operates off of what a President does (trade war, tax cuts etc)Freshell said: What does this even mean? By what economic metric are you saying the fed cut is "premature?" What does it even mean to be premature in this sense and what is so much? The fed almost always has cut rates by 25 basis points in the post-08 economy and 1-200 basis points over the course of a year or two is not "so much." Seriously, you people do know the Fed has cut rates three times this year already right?Yeah. I didn't want to get into the mud with that since "little to no effect" is subjective depending on what you think "little" means. Wanted to stick to the point that recessions are pretty inevitable and having the fed cut interest rates prematurely so much ain't smart. Edit: I saw some more bs I felt like responding to |

SilverstormDec 7, 2019 6:15 PM

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 7, 2019 9:57 PM

#28

Yudina said: The fed almost always has cut rates by 25 basis points in the post-08 economy and 1-200 basis points over the course of a year or two is not "so much." Seriously, you people do know the Fed has cut rates three times this year already right? I mean, a 200 basis point change is pretty massive when that would drop us at zero interest and below. We're at a historically low interest rate despite this being the longest expansion period. I don't want us caught with our pants down whenever the next one hits. Dropping interest rates is an important stimulative tool. Best case scenario if one were to happen soon, we drop interest rates near zero with them somewhere where we left off post'08 like we're some kinda whack-a-mole and have to climb out all over again. |

Dec 7, 2019 10:23 PM

#29

| @Yudina Lucky the mobile version of MAL doesn't let me post the way I'd like. One, dont believe you worked on nor worked with shit dealing with finances;barely believe you worked. So let's not try to support our positions with credentials that can't be proven. Two, none of what you said makes sense for the simple reason you already highlight the relationships in your wannabe counter to what I said--you just framed them as " they do but it's not longterm" or "it happens but they dont matter". My position that a president has influence over the economy is not false, they may not be the overseer of an economy but their fiscal decisions, influence over party and ability to negotiate trade and commerce globally disproves whatever 1 page post you can conjure. The Fed works independently doesn't remove the fact it works with the government, but makes said moves on how the executive branch conducts policy. And to this stupid assumption "Again if you seriously think the president affects the economy so much, you have to say that Bush was responsible for the financial crisis, which he wasn't. You have to say that Obama was responsible for the recovery, which he wasn't, and you have to say that Trump is responsible for the stock market at record highs, which he isn't. All of these are nonsense claims but you'd have to accept them if you think the president has that big of an effect on the macro level." What do you think the executive branch does, micro level things? Lol and again no, I dont have to agree to those things with my position. I think this thread needs more Yudina-bs, please..post more fun things that can be put down without large text walls |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 7, 2019 10:27 PM

#30

| debt itself is not an issue. liquidity is. from what i recall, Lehman financed itself with short term debt, and as the crisis unfolded, investors were not willing to roll over the debt. the result: Lehman had to try and come up with billions of dollars on the spot to meet its debt obligation. as you would expect, that didnt work out and they had ro declare bankruptcy as a result, resulting in a domino effect. this is a result of lack of regulation and economists thinking another crisis could not possibly happen, except it did. fun fact: Obama chose Bernanke on his first term, against the public expectation for a democrat to be chosen as Chairman. one of the reasons, if i remember correctly, is because Bernanke was a scholar of the Great Depression, and thus well equipped to handle the crisis. when the crisis turned out to be far worse than expected, Obama was under a strong pressure to change the chairman for his second term, but he still chose Bernanke. despite the strong hatred from democrats, he was still the only one well qualified to guide the country through the crisis. nobody else came close. it should be noted that there was a fight within the Fed itself, with some in the Fed fiercely opposing Bernanke. of course, Bernanke does not make the final decision of Fed's policy: every decision must be approved by the 12 fed presidents who can vote at the time. Bernanke was lucky to only have 1 guy voting against him when the fed made a vote to ease monetary policy and handle bail outs. |

| You can buy lossless digital music from your favorite Japanese artists on https://ototoy.jp/. The songs are all DRM-free and you can re-download your purchased albums as you wish. Show your support to your favorite artist if you can! ps. if you are looking for Japanese albums, you have to search it in Japanese (not romaji). Just copy and paste the name. For those who want to learn Japanese through anime Resources for learning the language |

Dec 7, 2019 10:49 PM

#31

Yudina said: Again with the reframing "no, they dont look majorly at how the executive.."--get a new trick.Silverstorm said: You're free to believe or disbelieve whatever you want, I really don't care, I'm merely drawing experience to explain why you're wrong. One, dont believe you worked on nor worked with shit dealing with finances;barely believe you worked. So let's not try to support our positions with credentials that can't be proven. Either way, at the end of the day, you're the one that's always saying you're too lazy to look up sources but then never respond to actual pressing examples. Just sayin'. Silverstorm said: The entire premise of my point is that the president does not have a lot of control over the economy; I don't care if the president has influence, they clearly do, my original point was an offshoot about how they simply do not exercise as much control as people would believe. It takes some of the most centralized and planned economies to enact sweeping changes to the economy and parliamentary/democratic/republics do not have the political capacity to imbue their executive branch with that kind of power.My position that a president has influence over the economy is not false, they may not be the overseer of an economy but their fiscal decisions, influence over party and ability to negotiate trade and commerce globally disproves whatever 1 page post you can conjure. The Fed works independently doesn't remove the fact it works with the government, but makes said moves on how the executive branch conducts policy Silverstorm said: Do you read what you're writing before you post? It works independently but it works with the government?The Fed works independently doesn't remove the fact it works with the government, but makes said moves on how the executive branch conducts policy. I mean I won't deny that there's a collaborative effort, but my point was never that the Fed does not work with the government, but rather that it relieves itself from political pressures. This is why the Fed has a routine of making calls during election years that damage or improve the sitting president's reputation. You'd think that if the Fed was somehow swayed politically as a result of the president they wouldn't make these kinds of seemingly political decisions, but they act on behalf of what they think financial markets need. And no, they don't look majorly at how the executive branch conducts policy. Do you even read Fed minutes? Like sure they've cautioned against trade tensions, but some of their primary economic metrics are inflation and the jobs report, neither of which has been heavily influenced by most presidential administrations. Where did all the jobs go that Obama created for instance? Most of them were temporary jobs that evaporated after the recession had passed. Silverstorm said: It's not a stupid assumption. You literally cannot prove the sorts of claims that you're making, so you're just wrong lolAnd to this stupid assumption "Again if you seriously think the president affects the economy so much, you have to say that Bush was responsible for the financial crisis, which he wasn't. You have to say that Obama was responsible for the recovery, which he wasn't, and you have to say that Trump is responsible for the stock market at record highs, which he isn't. All of these are nonsense claims but you'd have to accept them if you think the president has that big of an effect on the macro level." What do you think the executive branch does, micro level things? Lol and again no, I dont have to agree to those things with my position. I think this thread needs more Yudina-bs, please..post more fun things that can be put down without large text walls I always love it when people try to reframe these arguments in the broader context of the thread, as if more and more people need to read my "bs" because they'll see how much of an idiot I am. I don't really care for these observations, but really all it tells me is that you have nothing to say and hope that someone more intelligent than me comes over and tries to put me in my place so you can "agree" with their take down. Not really rereading my posts, as it's time consuming enough trying to make sure words are spelled accurate, as said earlier lucky mobile mal doesn't allow me to post the way I like and I'm not near a laptop. Me wait for "help" in someone else to "put you in a place"? I'm the last user to resort to that, I'd sooner say I was wrong as I've done many times when I am lol No, I want your spiel of horseshit so other readers can distinguish both arguments and decide for themselves. And as also stated earlier, I'm not going to waste my time gathering links on a phone to supply common sense to how government interacts with or to "independent" agencies under government--to which you already agree..jus sayin |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 7, 2019 10:55 PM

#32

Yudina said: Right, not sure what that's called when a person tries to not admit to something by saying things in a roundabout manner by trying to use words to downplay the point of the other. Also I never said that isn't what the Fed does so why you want to focus on what you said as if I implied it wasn't--grasping at air?Silverstorm said: This is just grasping at straws lmfao. Anyone who looks at Fed policy knows jobs numbers and inflation is their primary objective, but go ahead and think that I'm just doing these rhetorical flourishes to mess with you like some Socratic act put on by Plato.Again with the reframing "no, they dont look majorly at how the executive.."--get a new trick. |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 7, 2019 11:07 PM

#33

Yudina said: Do I need to define illiteracy as well for you--How does that show I said the Fed does not look at job reports nor inflation or how that even demonstrates that they don't take into consideration how the larger branches, more primarily the executive's actions, will influence either of those (jobs/inflation). Do you think they work in a vacuum lolSilverstorm said: Also I never said that isn't what the Fed does so why you want to focus on what you said as if I implied it wasn't--grasping at air? Silverstorm said: If you knew what the Fed did you wouldn't be so daft as to only mention that they make moves on "how the executive branch conducts policy," which is one of the least of their worries.The Fed [...] makes said moves on how the executive branch conducts policy. Silverstorm said: Right, not sure what that's called when a person tries to not admit to something by saying things in a roundabout manner by trying to use words to downplay the point of the other. Yudina said: So not only do you not know how the economy works, you also are illiterate? Good to know. :3I mean I won't deny that there's a collaborative effort, but my point was never that the Fed does not work with the government, but rather that it relieves itself from political pressures. At the end of the day you just keep supplying my point, its sad You must be the worst imaginary financial worker, its hysterical |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 7, 2019 11:08 PM

#34

| @Yudina Gary Gorton of Yale would beg to differ. the economists were asleep, confident that the Quiet Period, which started around 1932 would go on forever. there were no crisis for decades, so it seemed reasonable to assume the regulation in place were robust to handle any mishaps. too bad they missed the way banks were transforming their business by adding securitization, which itself was a result of competition and a need to introduce a more compelling product to the market. ironically, i guess, capitalism drove the banks to make a new debt instrument, which went unnoticed by regulators and ended up resulting in the crisis. an excerpt: Another competitor with bank loans was commercial paper (CP), a short term debt contract issued directly in the capital markets....Over the 1980s, the CP market grew at a 17% average annual compound growth rate. And as charter values declined in the face of all this competition, deregulation added to the ongoing transformation of the banking industry.... In order to stay competitive with nonbanks and their products, banks had to restore their profitability levels....banks needed to innovate in order to survive as profitable companies. The most important bank inmovation was securitization. Gorton, Misunderstanding Financial Crisis, pg 127-129 as for hating the Fed, the answer is obvious. billions of tax payer dollars on bail outs. nobody was punished, as popular opinion says should have happened. it so happened that Fed had to do its job, even if it was unpopular. as Gordon explained in the paradox of financial crisis: to help the common folk, the government must help the guys on wall street. it is a paradox because it goes contrary to what seems fair. |

DreamingBeatsDec 7, 2019 11:14 PM

| You can buy lossless digital music from your favorite Japanese artists on https://ototoy.jp/. The songs are all DRM-free and you can re-download your purchased albums as you wish. Show your support to your favorite artist if you can! ps. if you are looking for Japanese albums, you have to search it in Japanese (not romaji). Just copy and paste the name. For those who want to learn Japanese through anime Resources for learning the language |

Dec 8, 2019 8:21 AM

#35

DreamingBeats said: as for hating the Fed, the answer is obvious. billions of tax payer dollars on bail outs. nobody was punished, as popular opinion says should have happened. it so happened that Fed had to do its job, even if it was unpopular. as Gordon explained in the paradox of financial crisis: to help the common folk, the government must help the guys on wall street. it is a paradox because it goes contrary to what seems fair. That is the most succinct point. Barring a draconian executive branch, it is impossible to stop the fed from cutting or raising rates. Then private banks approving loans to risky corporations. So when the corporations fail or go bankrupt the bank is left holding the bag. Whom, is then bailed out by the government, whom is funded via tax dollars. I mean if you want to go all US Treasury bonds and BEP, thats cool. If one cannot exercise control over whom is lended what, then one should not be responsible for bailing them out. Though I am sure scooping up all that foreclosed real estate and reselling it helped a little. |

SoverignDec 8, 2019 8:28 AM

|

Dec 8, 2019 9:12 AM

#36

Yudina said: DreamingBeats said: I don't know what you mean by ironically. Capitalism encourages the development of these kinds of instruments that go unregulated and have unwarranted catastrophic effects on the economy. That's all part of the plan.@Yudina Gary Gorton of Yale would beg to differ. the economists were asleep, confident that the Quiet Period, which started around 1932 would go on forever. there were no crisis for decades, so it seemed reasonable to assume the regulation in place were robust to handle any mishaps. too bad they missed the way banks were transforming their business by adding securitization, which itself was a result of competition and a need to introduce a more compelling product to the market. ironically, i guess, capitalism drove the banks to make a new debt instrument, which went unnoticed by regulators and ended up resulting in the crisis. DreamingBeats said: This just seems wrong in every way. What do you mean by there was no crisis in decades? Even as early as the 2000s there was the Dot Com bubble burst, then there was the Savings and Loans Crisis in the 80s to 90s not to mention the ripple effects of the Asian Debt Crisis at the end of the 20th century that coincided with dot com. A recession wasn't even that far from memory. There were two recessions at the end of the 90s and beginning of the 2000s, the former marked by high inflation and the oil shock of the 90s and the latter by the aforementioned dot com bubble.an excerpt: Another competitor with bank loans was commercial paper (CP), a short term debt contract issued directly in the capital markets....Over the 1980s, the CP market grew at a 17% average annual compound growth rate. And as charter values declined in the face of all this competition, deregulation added to the ongoing transformation of the banking industry.... In order to stay competitive with nonbanks and their products, banks had to restore their profitability levels....banks needed to innovate in order to survive as profitable companies. The most important bank inmovation was securitization. Gorton, Misunderstanding Financial Crisis, pg 127-129 As for economists, people as early as 2004 were commenting on the risks of mortgage backed securities. In 2005, the NYU economist Nouriel Roubini predicted that the economy was in the midst of a housing crisis bound for a bubble. The investigative findings almost certainly definitively proved that Moody's, S&P, and Fitch were all aware that the CDOs, CDS's, and MBS that were being graded on the market were garbage but because they needed to keep their client base, they spun them as AAA. DreamingBeats said: Eh, if billions of tax payer dollars on bail outs was enough to hate one institution, you'd think Americans would hate their military or the industry that funds it, but they don't. If anything, the bailouts had a net positive effect on the balance sheet because the banks paid back everything that was given to them and then some.as for hating the Fed, the answer is obvious. billions of tax payer dollars on bail outs. nobody was punished, as popular opinion says should have happened. it so happened that Fed had to do its job, even if it was unpopular. as Gordon explained in the paradox of financial crisis: to help the common folk, the government must help the guys on wall street. it is a paradox because it goes contrary to what seems fair. the dot com bust did not bring the US economy to its knees. there were isolated crisis here and there, but not one that affected the entire economy as a whole. that is what was meant as the Quiet Period. some people lost money during the quiet period for sure, but the economy as a whole was chugging alone just fine...until 2007 that is. there were some economists warning about a potential economic catastrophe, but they were the minority. no-one paid attention to them. its easy to see the errors made ex-post. |

| You can buy lossless digital music from your favorite Japanese artists on https://ototoy.jp/. The songs are all DRM-free and you can re-download your purchased albums as you wish. Show your support to your favorite artist if you can! ps. if you are looking for Japanese albums, you have to search it in Japanese (not romaji). Just copy and paste the name. For those who want to learn Japanese through anime Resources for learning the language |

Dec 8, 2019 9:14 AM

#37

Yudina said: Soverign said: Eh, if billions of tax payer dollars on bail outs was enough to hate one institution, you'd think Americans would hate their military or the industry that funds it, but they don't. If anything, the bailouts had a net positive effect on the balance sheet because the banks paid back everything that was given to them and then some. Think the government made at least half a billion from the bailouts.That is the most succinct point. Barring a draconian executive branch, it is impossible to stop the fed from cutting or raising rates. Then private banks approving loans to risky corporations. So when the corporations fail or go bankrupt the bank is left holding the bag. Whom, is then bailed out by the government, whom is funded via tax dollars. I mean if you want to go all US Treasury bonds and BEP, thats cool. If one cannot exercise control over whom is lended what, then one should not be responsible for bailing them out. Though I am sure scooping up all that foreclosed real estate and reselling it helped a little. The point is, if the common man owes back taxes or goes bankrupt he loses his shit. Not so for the banks and wall street. They get bailed out. Of course you could make the argument the 1% pay the majority of the taxes, so they are just reimbursing themselves. The same as I could make the argument about the petro dollar and how the MIC props it up. None of the private institutions are actually necessary. Only the MIC and the tangible real power and resources it wields. |

|

Dec 8, 2019 12:24 PM

#38

Yudina said: I'm not here to defend the Fed, mind you. I'm just saying you could ostensibly hate on every other institution for similar reasons; I'm mostly just amused by how much people hate the Fed in particular. Like why not hate bankers instead like I do? :3 most people hating probably dont know how the Fed works or how the bailout decisions were made. (people tend to be vocal and overconfident for things they have little knowledge of) long story short, a lot of hairs were pulled in the entire process, and some Fed presidents themselves strongly disagreed with the bailouts. Bernanke got his way in part due to sheer luck. i believe that there was also hatred towards banks, but the Fed is seen as the one who ultimately gave the tax payer money and saved the undeserving banks. i cant comment much about banks other than they rely on debts to make money (that is their entire business model). i have a book called The Banker's New Clothes sitting in the shelf waiting to be read. it supposedly takes all bankers excuses for having little capital and all the technical jargon and tears them apart in plain english. |

| You can buy lossless digital music from your favorite Japanese artists on https://ototoy.jp/. The songs are all DRM-free and you can re-download your purchased albums as you wish. Show your support to your favorite artist if you can! ps. if you are looking for Japanese albums, you have to search it in Japanese (not romaji). Just copy and paste the name. For those who want to learn Japanese through anime Resources for learning the language |

Dec 8, 2019 2:24 PM

#39

Yudina said: I'm not here to defend the Fed, mind you. I'm just saying you could ostensibly hate on every other institution for similar reasons; I'm mostly just amused by how much people hate the Fed in particular. Like why not hate bankers instead like I do? :3 I don't. I just like phrasing things in incendiary ways when I get the chance. ;P Makes the thread more fun, ya know? Trump ostensibly wants the Fed to intervene more despite his base being the kind who don't even want it to exist. Plus it's a traditional American pass time. When I stub my toe, I say "Fed damn you!" Back in my day, you could get a bag of throat lozenges for a nickel and a dime I tell ya. Kids don't have any sense these days cuz they don't even save their cents! |

Dec 8, 2019 2:30 PM

#40

| Expected, a user that rather drop the discussion without saying they were wrong or clarifying how they possibly misunderstood another's post. Cowards, done here till otherwise. Thank you to Freshell for making it though- reminded me before I left the site how much forum decorum in general has changed from trying to uncover perspectives on a topic while proving a point to people trying to just "win" a point. Atleast the silverlining is some users consider this a stronger community than in the last couple years; a sliver of hope for this site. Unfortunate the quality of some of those same user(s) is less than in previous years. I miss 2009. |

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 8, 2019 3:03 PM

#41

Freshell said: Yudina said: I'm not here to defend the Fed, mind you. I'm just saying you could ostensibly hate on every other institution for similar reasons; I'm mostly just amused by how much people hate the Fed in particular. Like why not hate bankers instead like I do? :3 I don't. I just like phrasing things in incendiary ways when I get the chance. ;P Makes the thread more fun, ya know? Trump ostensibly wants the Fed to intervene more despite his base being the kind who don't even want it to exist. Plus it's a traditional American pass time. When I stub my toe, I say "Fed damn you!" Back in my day, you could get a bag of throat lozenges for a nickel and a dime I tell ya. Kids don't have any sense these days cuz they don't even save their cents! That actually ties into everything that has been said previously in the thread however. Switching from the gold backed dollar to the establishment o thef Federal Reserve. https://www.federalreservehistory.org/essays/great_depression That had to be bailed out by the MIC (Military Industrial Complex), also known as WWII (which was a centrally planned war time economy, where the government dictated every bullet and bean to be produced and who got how many of them). Then the petro dollar. In 2002, Ben Bernanke, then a member of the Federal Reserve Board of Governors, acknowledged publicly what economists have long believed. The Federal Reserve’s mistakes contributed to the “worst economic disaster in American history” (Bernanke 2002). Bernanke, like other economic historians, characterized the Great Depression as a disaster because of its length, depth, and consequences. The Depression lasted a decade, beginning in 1929 and ending during World War II. Industrial production plummeted. Unemployment soared. Families suffered. Marriage rates fell. The contraction began in the United States and spread around the globe. The Depression was the longest and deepest downturn in the history of the United States and the modern industrial economy. |

SoverignDec 8, 2019 3:13 PM

|

Dec 9, 2019 7:39 AM

#42

| in the past, the President was also able to influence public opinion and stop the ran on banks by just making a public speech, way before the Fed and FDIC were created. one obvious example is Roosevelt and his speech made in March 12, 1933. It was a remarkable speech. The next day depositors lined up to redeposit their money in the banks. The Emergency Banking Act was passed with alacrity, and there was no legal challenge to the bank holiday. - Gorton, pg 117 the author also compares with the immediate response by the presidents during the 2007-2008 crisis - neither Bush nor Obama were able to make a speech as powerful to influence public opinion. |

| You can buy lossless digital music from your favorite Japanese artists on https://ototoy.jp/. The songs are all DRM-free and you can re-download your purchased albums as you wish. Show your support to your favorite artist if you can! ps. if you are looking for Japanese albums, you have to search it in Japanese (not romaji). Just copy and paste the name. For those who want to learn Japanese through anime Resources for learning the language |

Dec 9, 2019 10:29 AM

#43

Yudina said: Sure, cause the President now doesn't represent the executive branch. And yeah, your bad reading skills seems to like to put words in posts (no one but you just said a president has majority control over monthly jobs report) and thanks for those things you listed to add to what I already listed demonstrating how a president influences the economy. You did the same earlier with NAFTA and a few others (Treaties that support globalism is already known) and you went back on what your point was with your Obama example. Your not good at this exchange of points. Still sad you keep supplying my point, but feel free to continue--it is cowardly cause you seem so insecure as to not be able to say you were wrong from misreading my initial post. Funny we spent this weekend talking about the Fed since Paul Volcker died this morning. :3 Good good good. I mean all in all he didn't seem that bad a guy. Didn't like the banks. Fine with me Silverstorm said: lmfaoExpected, a user that rather drop the discussion without saying they were wrong or clarifying how they possibly misunderstood another's post. Cowards, done here till otherwise. Your last point tried to establish that the president had a majority control over a monthly jobs report which is ridiculous and you've conveniently changed your position from "president" to the "executive branch," so how's that for trying to dodge the inevitable? Further, you literally could not provide a single example of the president influencing inflation or employment figures, even though there have been clear times when it's happened (TARP, Obama's 1bn stimulus, 70/80s negotiation with OPEC, etc. etc.). The fact you yourself cannot provide these examples outside of "common sense logic" is a tell tale sign that you don't know anything about finances or economics. Or history. Or maybe anything to be honest. I apologize if you think me dropping a discussion with a philistine is cowardice. I hope the boots of capitalism don't kick you on the way out. o/ Is making assumptions not in another's post, or using words they never posted the only thing you know how to do? cause that is literally about 95% of what this exchange was. Atleast the other 5% was of some interest Edit: Wow didnt even read that last post of yours. Thanks, I couldn't have done this without you, really. Spend some more time in the forums and maybe you'll get better at defending your position. At this point its visible you're baiting me cause you have no opposing view and no means of articulating it if it did exist. @DreamingBeats MAL on phone is a different beast than pc, I miss alot of posts until rereading (and no quick edit button--may have to come back when not on mobil); Bankers New Clothes was really informative to me, it broke down alot of concepts and practices to more digestible understanding. If I could suggest another book, After the music Stopped pairs well with it cause the author (Alan Blinder) had some good insights into the causes and interesting ways of ensuring things don't happen again but his approach does have limitations that some might not think is enough. |

SilverstormDec 9, 2019 11:03 AM

| "In the end the World really doesn't need a Superman. Just a Brave one" |

Dec 9, 2019 10:47 AM

#44

| can we please stop with the whole "im right you wrong you coward newb you proved me right" posts? not only do they not provide anything meaningful to the discussion, it makes you appear rather immature and the rant only serves to derail the entire thread. if you cant make a strong argument that backs up your claim, you should not be surprised if people call you out (and in Yudina's case, it wasnt even confrontational. in fact, Yudina was only responding to your attempt at correcting them, only to backfire at you). calling anyone and everyone who disagrees with you a "coward" is an ad-hominen and reflects your lack of understanding on the subject matter. maybe you are well informed on the subject, but that is not reflected in your previous posts. edit: there is certainly a vast and rich literature detailing the crisis of 2007-2008. After the music stopped is certainly one of the most reccomended reads (i plan on reading it someday), though Bull by the Horns (written from the point of view of the FDIC chair), A courage to change (written from the pov of the Fed - Bernanke) as well as several others also retell what happened from their unique perspectives. of course, there needs to be some skepticism when reading them, since the authors will often portray their actions as being more heroic than warranted. another one that is strongly recommended is Too Big to Fail, written from the pov of a NYT reporter. |

DreamingBeatsDec 9, 2019 11:24 AM

| You can buy lossless digital music from your favorite Japanese artists on https://ototoy.jp/. The songs are all DRM-free and you can re-download your purchased albums as you wish. Show your support to your favorite artist if you can! ps. if you are looking for Japanese albums, you have to search it in Japanese (not romaji). Just copy and paste the name. For those who want to learn Japanese through anime Resources for learning the language |

Dec 9, 2019 2:05 PM

#45